The Pensions Ombudsman (TPO) has published his annual report for 2020/2021 (the Annual Report). The Annual Report shines a spotlight on TPO’s activity, highlighting trends and developments. Charlotte Scholes looks at some of the most relevant points for trustees to consider when dealing with member complaints, internal dispute resolution procedures and TPO claims.

What are the key points from the Annual Report?

Headlines from the Annual Report

- Around 85% of pension complaints are closed at the early resolution stage. These are complaints that did not go through schemes’ IDRP or lead to a complaint being lodged with TPO.

- Only 6.6% of complaints made it to a formal determination by TPO.

- Demand for TPO’s services has remained roughly the same as last year.

- Appeals from TPO determinations are at their lowest level for ten years.

Has COVID-19 had an impact?

Unsurprisingly, the answer is yes. The pandemic restricted TPO’s interaction with organisations with whom it needed to gather information to progress cases. Restricted access to TPO’ s own offices also had an impact.

How is TPO managing its caseload?

TPO has a very significant caseload. Its early enquiries team received 16,673 contacts last year. To handle this significant load, TPO has an effective triage system and filters out enquiries from genuine complaints. Through a new system it adopted during the pandemic (its Casework Reorganisation Programme), TPR has an assessment period which closed a significantly higher number of complaints even before its early resolution or adjudication stages. The precise numbers are stark: 2474 closures this year versus 1131 last year.

According to this year’s report, nearly half of the closures that took place at this earlier stage were because the complaint was deemed invalid or rejected on other grounds. Somewhat surprisingly, nearly 30% of complaints which were closed early were not progressed owing to insufficient information being provided. A surprising 18% were closed as complainants did not agree to the matter being resolved early by TPO’s Early Resolution Team.

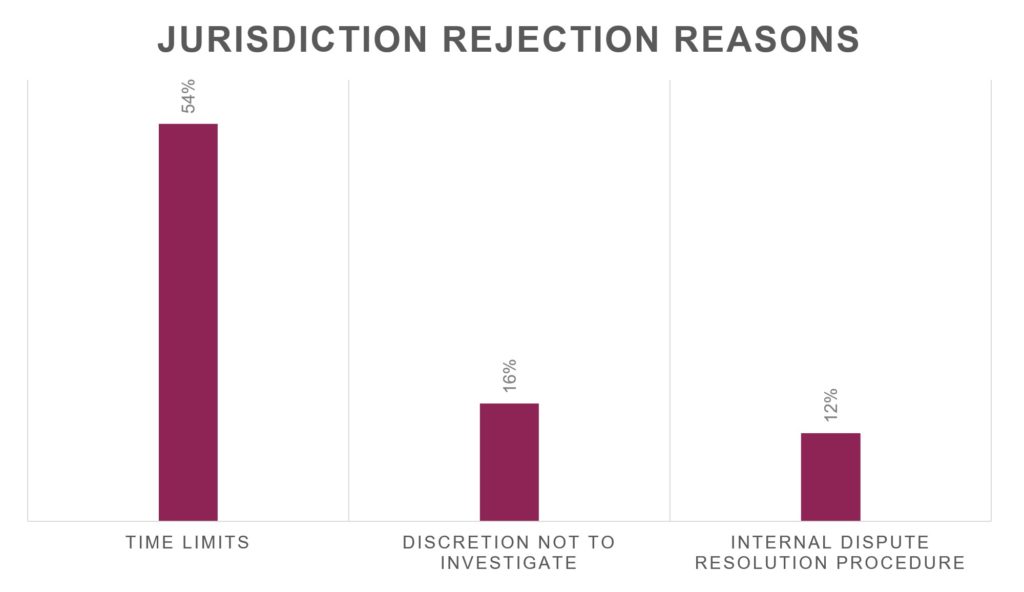

The remaining 10% were rejected for the following reasons:

The top 11 causes for complaint in 2020/21

While transfer-based complaints were the clear “winner” last year, there is no clear most prevalent cause of complaint, instead the causes were pretty evenly spread.

| Complaint type | % of investigations for year 2020/2021* | % of investigations for year 2019/2020 | % of investigations for year 2018/2019 and position in top ten | |

| 1 | Transfers | 12.7 | 23.6 | 11.24 (2nd) |

| 2 | Misquote | 11.9 | 14.1 | 8.49 (4th) |

| 3 | Ill-health | 9.6 | 9.8 | 8.41 (5th) |

| 4 | Administration | 9.4 | 9.1 | 4.64 ((8th) |

| 5 | Retirement benefits | 13.2 | 8.2 | – |

| 6 | Contributions | 4.3 | 7.3 | 2.59 (10th) |

| 7 | SIPP/SSAS | 4.1 | 3.5 | – |

| 8 | Membership | – | 3.4 | – |

| 9 | Death benefits | 5.1 | 1.7 | 5.50 (7th) |

| 10 | Overpayments | 5.2 | 2.9% | 3.38% (9th) |

| 11 | Scheme Rules | 3.7 | 2.3 | – |

* A percentage in red indicates a reduction from the previous year. A percentage in green indicates an increase.

What is coming next?

Last year, Anthony Arter stated that his office was:

prepared for a potential increase in the number of complaints received. This will include those relating to the furlough scheme, scams and transfers, payment of auto-enrolment contributions, pension benefit claims concerning ill-health and redundancy and delays in providing information and processing requests.

TPO Annual Report 2019/20

So did any of those types of complaint emerge? Not as far as we can tell. But in our view, it’s only a matter of time. In practice, we are seeing an increase in the number of complaints being made (often from claims-handling companies) based on transfers from pension schemes.

While the above figures do not reflect an increase in complaints based on the furlough scheme, transfers, scams and contributions, there may be a variety of reasons for this. For a start, the furlough scheme is only just winding up. Might it be (in other cases) that some of these complaints are sitting in the TPO pipeline? Or could it be that the “loss”/ “harm done” is yet to crystallise or emerge?

In our view, there could be at least a 6-12 month lead time for these types of complaint to emerge and we could see more of the types of complaints during the autumn and 2022.

Trends at the TPO

- A notable trend which has emerged this year is that complaints are becoming increasingly complex, which is impacting on the time taken to investigate them: words worth bearing in mind if you find yourself faced with responding to a complaint lodged with TPO and want an idea of timescales.

- Interestingly, there have been less in the way of appeals from TPO’s determinations and last year saw the lowest number of appeals in the last 10 years. It is not clear why this is but, given that an appeal application has to be made to the High Court, it may be that the lockdown period impacted on parties’ decisions to make an appeal.

Notable cases – a brief round up

- Trustee wrongdoing – the Norton Motorcyles (CAS-30918-M4P3) case gave rise to a very significant and lengthy determination against Stuart Garner. Mr Garner was found to have acted dishonestly, in breach of his statutory duties in relation to investments and in breach of his duties to acquire knowledge and understanding. There were also other multiple examples of maladministration.

- Overpayments – in the case of Mr E (PO-29198), TPO considered recoupment and equitable set-off. While recoupment is available to trustees of pension schemes, it cannot be used where a scheme was set up under statute with no trustees. In those situations, the similar remedy of set-off has to be used. Accordingly, the member (Mr E)’s entitlement and the pension overpayment (due to the Teachers Pensions Scheme) were treated as cross-claims which could be offset against one another. Accordingly, TPO concluded that the scheme could use equitable set off to effectively recover the overpayment.

- Discretionary Death Benefits – while Mr S’s case did not make it as far as Antony Arter himself, it is a useful reminder of the likely stance of TPO to discretionary death benefit cases. The beneficiary (Ms D) was awarded 50% of the lump sum. While there was a disagreement as to whether she was entitled to this sum under the scheme’s rules, she had been listed as Mr S’s next of kin, been named on the expression of wishes form and in his will. That eventually led (together with additional evidence produced by Ms D) to the Trustee paying Ms D 50% of the lump sum. The Trustee kept aside the other 50% for two years in case any of the deceased’s family came forward, including the deceased’s daughter. Ms D was not content with this outcome. TPO adjudicator agreed it was not acceptable for the Trustee to sit on this sum for two years, when the Trustee as making no active efforts to locate Mr S’s daughter and when retaining the sum for more than two years (and then paying it out) was likely to result in Ms D receiving an unauthorised payment. The parties accepted the adjudicator’s opinion that the Trustee should take a decision about the remaining 50% of the lump sum, and if the Trustee decided it should go to Ms D, they should also cover the cost of any adverse tax charges arising from it being paid outside the two year period. The adjudicator also said that the Trustee should pay Ms D £500 for the significant distress and inconvenience she had suffered. Both parties accepted the adjudicator’s opinion so the complaint was resolved without a determination.